How The New Postcard-Sized 1040 Differs From Your Current Tax Return

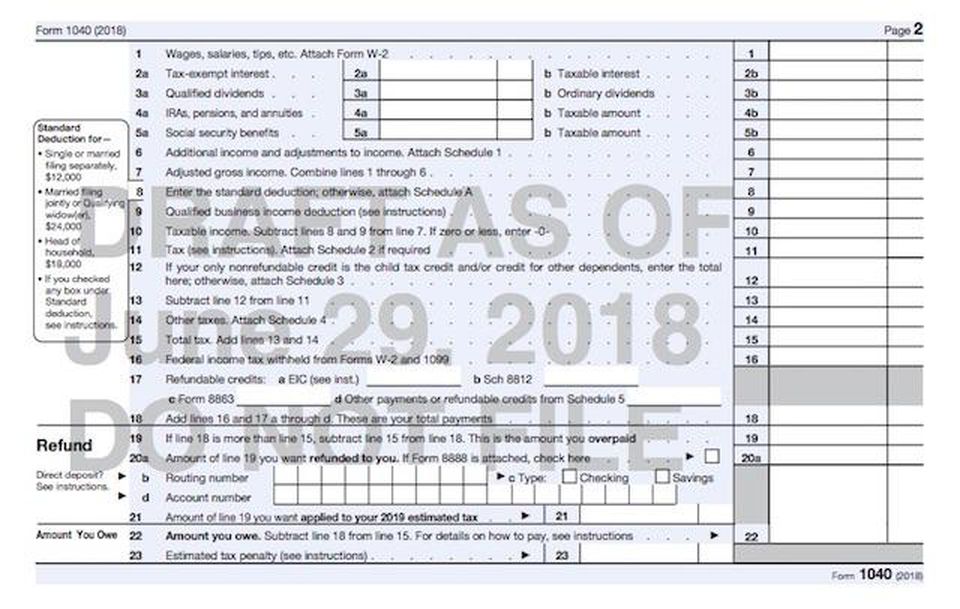

Curious as to what the new postcard-sized tax return might look like? The Internal Revenue Service (IRS) has released a proposed draft of the return. It looks like this:

You can see the full-sized copy here (downloads as a pdf).

Despite the smaller size, the new form 1040 is intended to replace not only the current form 1040 but also forms 1040A and 1040EZ.

But don’t start printing copies yet. The IRS warns:

This is an early release draft of the 2018 IRS Form 1040, U.S. Individual Income Tax Return, which the IRS is providing for your information, review, and comment… Do not file draft forms. Also, do not rely on draft forms, instructions, and publications for filing.

(emphasis added)

The IRS goes on to say:

We generally do not release drafts of forms until we believe we have incorporated all changes. However, in this case we anticipate it is likely that this draft will change at least slightly before being released as final. Whether this draft changes or not, we will post a new draft later this summer with our standard coversheet indicating we do not expect that draft to change.

(emphasis added)

You’ll note that the two-page draft form is smaller than the current two-page form, but that’s because many line items have been consolidated and/or shifted to other forms and schedules. Here’s how the current and draft forms are alike and how they differ:

- Names and Social Security Numbers. The spaces for names and Social Security numbers remain largely the same.

- Signatures. The spaces for signatures remain on page one and are largely the same, but there is no longer a separate signature box on page two.

- Filing Status. On the original form, you could choose one of five filing statuses: Single, Married filing jointly, Married filing separately, Head of household, or Qualifying widow(er). On the draft form, you will only indicate if your filing status is one of three filing statuses: Married filing separately, Head of household, or Qualifying widow(er). However, there are still five filing statuses under the new law. I’m assuming that with the new design, the IRS will default to Single for one name and Married filing jointly for two names unless a box is ticked.

- Presidential election campaign. The option to contribute to the Presidential election campaign remains the same (you can read more about that here).

- Health care coverage. Health care coverage is still mandatory for the 2018 tax year. On the current form 1040, that information is reported on line 61 (an additional form may be required). On the draft 1040, that information is noted via a checkbox on the front page (and yes, an additional form may still be required).

- Personal exemptions. There are no personal exemptions available for the tax years 2018 through 2025, so those line items have been removed on the first and second pages of the form 1040.

- Dependents. On the current form 1040, there was space on the front page to list four dependents. On the draft form, there is just space for two. That means that families like mine (I have three kids) will need to add another page.

- Income reporting. On the draft form, the income reconciliation (that block on the front page where you used to transfer your items of income from separate schedules) has been moved from the first page of the return to the second. Here’s what you’ll also notice:

- Many of the items have been consolidated onto on smaller lines; for example, Taxable interest and Tax-exempt interest used to be on two lines but are now squished (that’s the technical term) onto one line.

- There are no separate line items for individual schedule reconciliation. There used to be a line to enter your income from each of Schedules C, D, E, and F, but those are now reported on a new Schedule 1. The new Schedule 1 – still in draft form – will have 37 lines. You can see it here (downloads as a pdf).

- Adjusted income reporting. The most noticeable change is the elimination of this entire block found on page one of the current 1040. Most of those line items (those not eliminated) have been consolidated on other lines or the new Schedule 1. It’s worth noting that good ol’ line 37 (adjusted gross income, or AGI) will now be line 7; pay attention to this moving ahead since many other federal (and financial) forms ask for AGI by line number.

- Standard deduction. Your standard deduction amounts still appear on page two, but the amounts are different (you can find the new amounts here).

- Qualified business deduction. Remember the new qualified business deduction? The potentially confusing one that requires a flowchart to understand? It gets just one line on the new 1040 with a note to “see instructions” – that certainly means there will be additional forms and/or schedules. We haven’t gotten a peek at those yet.

- Tax credits. The numerous separate lines for tax credits has been consolidated to one which says: “If your only nonrefundable credit is the child tax credit and/or credit for other dependents, enter the total here; otherwise, attach Schedule 3.”

Wait? Schedule 3? What happened to Schedule 2? The reference to the new Schedule 2 appears on line 11 where you figure your tax. The form 1040 advises you to “see instructions” (as before) but now adds “Attach Schedule 2 if required.” Schedule 2 is just a reconciliation schedule. You can see it here (downloads as a pdf).

Schedule 3 is also a reconciliation schedule. You can see it here (downloads as a pdf).

You can see Schedule 4, which combines other taxes due, like Medicare and Social Security taxes, household employment taxes, and the Net investment income tax here (downloads as a pdf).

You’ll note that the new schedules use numbers for identification purposes. That’s because the schedules which use letters, like Schedule C, are still in play. Those will be modified to reflect changes in the tax law, but we haven’t seen drafts of those just yet. You can see what I think Schedule A will look like here.

And we’re not done with new schedules yet:

- Payments. The ten separate lines for tax payments, including certain tax credits, have been consolidated into a line for withholding; another line for refundable tax credits and instructions to complete a separate Schedule 5 if needed. You can see the new Schedule 5 here (downloads as a pdf).

- Third Party Designee. The space that previously allowed you to designate another person to discuss this return with the IRS has been moved to a new Schedule 6, though there is a tick box if you wish for your preparer to be a Third Party Designee. You can see the new Schedule 6 here (downloads as a pdf).

So, to recap:

- We have a smaller form 1040. Sort of.

- Good-bye forms 1040A and 1040EZ: All 150 million taxpayers are expected to use the same form.

- There are lots of new schedules – at least six.

- Some line items, like personal exemptions, have been eliminated because the corresponding tax items have been axed.

- Many existing line items have been consolidated.

- The result? Not counting new schedules, signature spaces and tick boxes, the new 1040 has just 23 lines (the current form has 79).

- Did I mention the font? Get your magnifying glass ready – the font is small (trigger warning: you, like me, might flashback to those college assignments where you spent hours shrinking the font, rather than editing your work, to make the text fit).

If you have comments about the draft 1040, you can email those to WI.1040.Comments@IRS.gov. The IRS cannot respond to all comments due to high volume.

Of course, most of this is ceremonial, right? Nearly 90% of taxpayers are expected to use a tax preparer or file electronically, making the length of the tax form more or less moot. But a postcard-sized return sure looks good in a campaign ad.

The IRS posted more than 50 drafts of revised forms and new schedules on its website this month. Many of the changes are tied to the Tax Cuts and Jobs Act, or TCJA (you can read more on those changes here and see the new tax rates here). In her report to Congress, National Taxpayer Advocate (NTA) Nina E. Olson called the implementation of the TCJA the IRS’ “most significant challenge” of 2018 (you can read more about the report here).

The information in this post is from Kelly Phillips Erb, The Tax Girl, writing for Forbes. https://www.forbes.com/sites/kellyphillipserb/2018/06/30/heres-how-the-new-postcard-sized-1040-differs-from-your-current-tax-return/#1da0289646cc